We know that time is more valuable than money so why not free up your workforce and maximize your time spent on profit-generating activities? We will reduce your headaches by functioning as your external business partner with the expertise in handling all the payroll administration activities such as Salary Processing, provident funds processing, E.S.I, bonuses, Gratuity, incentives, medical claims, Bank accounts Opening, corporate insurance policies and employees leaves.

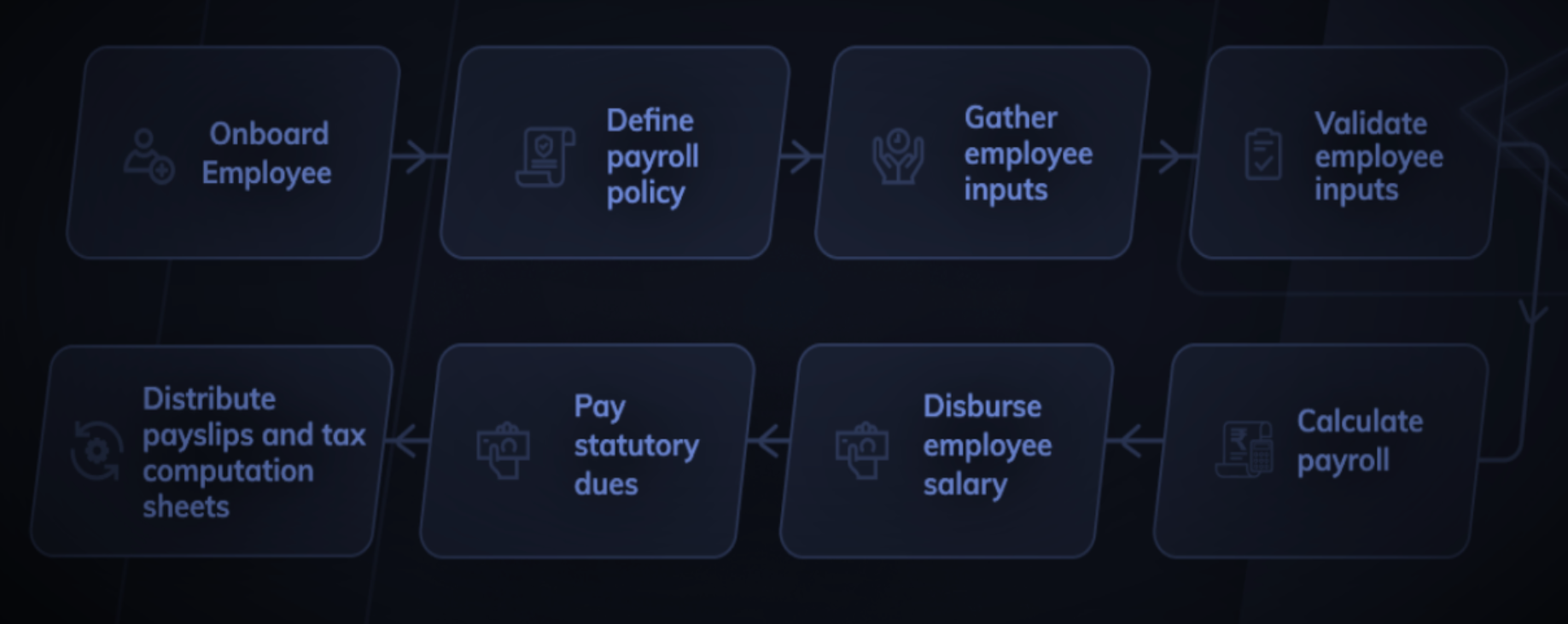

1. Onboard employees

As the first step of payroll processing, businesses should onboard employees and prepare a list of employees to be paid.

2. Define your payroll policyIn this step, businesses should define their policies and get them approved by the upper management to ensure standard payroll execution. These policies include pay policy, leave and attendance policy, employee benefits policy, etc.

3. Gather employee inputsEmployee inputs like PAN, address, bank account details, etc. are crucial for payroll processing. Usually, these inputs are collected from employees at the time of joining by the concerned teams.

4. Validate employee inputsOnce the inputs are received, check for validity of the details with respect to company policy, approval model, etc. Also, ensure that all active employees are taken into consideration, and no former employees are included for salary and compliance payments.

5. Calculate payrollThis step validated inputs are fed into the system for processing payroll. This results in net payment calculations after adjusting necessary deductions and taxes due.

6. Disburse employee salariesIn this step businesses need to ensure that their bank account has sufficient funds to make salary transfers. Then, a salary bank advice statement is sent to the concerned bank directing the bank to disburse salaries. All these time-consuming tasks can be avoided with one-click salary disbursement feature of automated payroll software.

7. Pay statutory duesAt the time of payroll processing, all statutory deductions such as PF, TDS, ESI and PT are deducted. Then, these payments are made to the appropriate government departments with the due dates.

8. Distribute payslips and tax computation sheetsThis step involves payslip distribution employees, along with their tax computation sheets.

Consulting Agency for Your Business

Rojgar For You provide one stop solutions for all man power relevant services.